Traditional Or Roth Tsp - "I was on a regular TSP and now I'm over 5 years away from retirement. Should I change my allocations to contribute to a ROTH TSP?"

Understanding the difference between traditional and Roth TSP contributions is critical to long-term financial planning. Before we get into answering whether it makes financial sense to change your contributions from a traditional TSP to a ROTH TSP, let's start by understanding the difference between the two.

Traditional Or Roth Tsp

As financial planners who regularly work with federal employees, we hear a lot of "Fed Speak" or common language or terms used by federal employees. Sometimes they are correct and sometimes they are not. That's why we always like to start from scratch. As you know, the beginning is always a good place to start.

How To Make The Traditional Vs. Roth Tsp Decision

Financial topics can be complex, and by having a better understanding of each, you can better inform yourself about what might be appropriate for your particular situation.

This is the tax-deferred component of the TSP. Once made, 100% of your employer contributions are deposited into this account – regardless of the withdrawals you make as a participant.

The money you contribute to the Traditional TSP has not yet been taxed. These taxes are instead deferred until later when you withdraw the money.

What's really important to understand about a traditional TSP is its tax-deferred status. 100% of your employer contributions are paid tax-deferred. During your working years when your taxes are generally high (especially as you approach High-3), this can provide some tax relief as the funds are provided on a pre-tax basis.

Tsp Roth Option Now Available > Air Combat Command > Article Display

However, keep in mind that when you withdraw money from your TSP and make a distribution from a traditional TSP, you pay taxes at that rate at that time. It is often a misconception that taxes are lower in retirement. This is entirely dependent on your personal situation and tax law. Retirement does not necessarily guarantee that you are in a lower tax bracket. Keep this in mind when planning.

This is the part of the TSP where your contributions were made on an after-tax basis. The money you set aside for a ROTH TSP was taxed at your current tax rate at the time you contributed. These contributions are after tax.

Keep in mind that your employer contributions are never paid after tax. Your employer contributions, regardless of what withdrawals you personally make from your own money, are made before tax.

This means that if 100% of your TSP contributions go to a ROTH TSP, your employer contributions will still be made into a traditional TSP.

The Only Reasons To Ever Contribute To A Roth Ira

You don't get a tax deduction for contributing money to a ROTH TSP. You contribute to your ROTH TSP after taxes. When you withdraw money and make distributions, you do so tax-free, provided you have done so in accordance with the rules of the investment rules.

It is not a black and white issue as everyone's tax situation is different. Even if you're 5 years away from retirement, that doesn't mean switching gears and contributing to a ROTH TSP is the best decision for you.

We love ROTHs because these investments allow for tax-free planning. But they are not always our standard answer because you need to understand a person's particular income tax situation now and in the future.

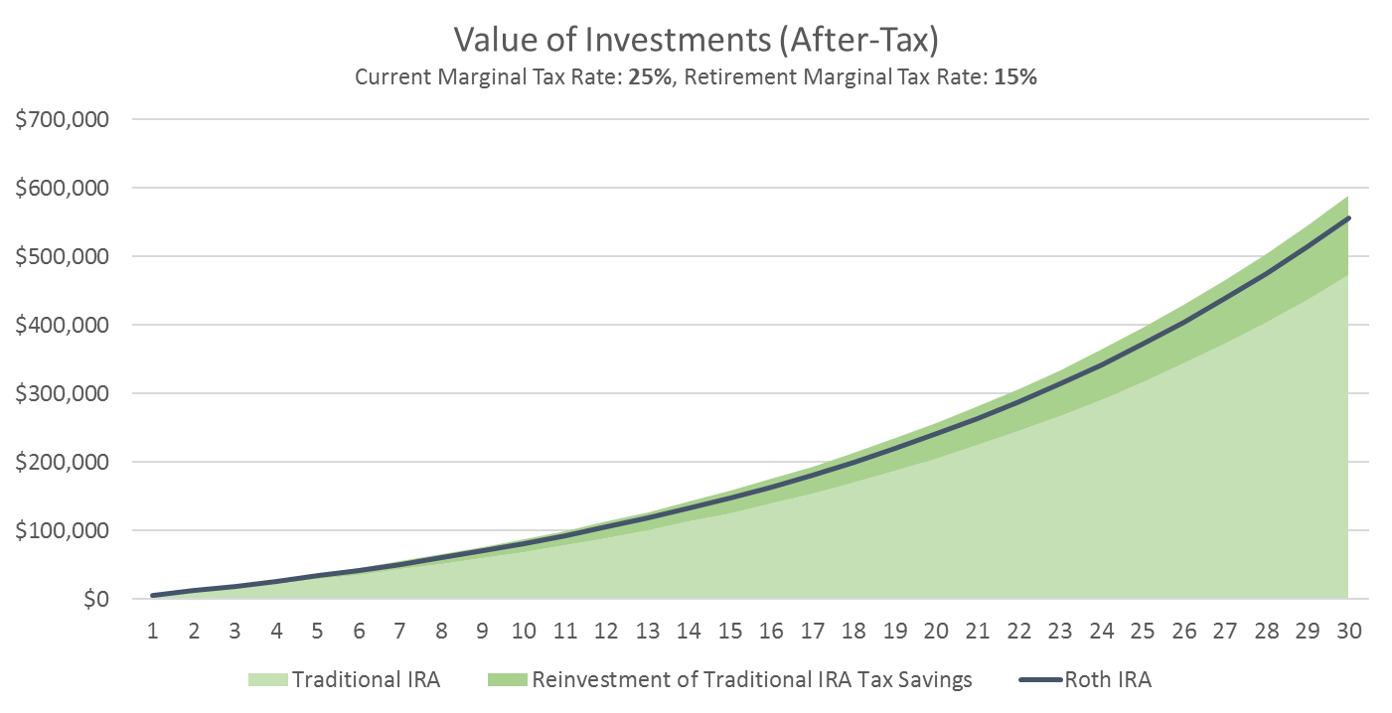

Deciding whether to contribute to a Traditional vs ROTH TSP is a tax planning issue. Contributing to a traditional TSP means you will be doing so on a tax-deferred basis. Contributing to a ROTH TSP means you pay taxes today and plan to withdraw the money later tax-free, as long as you qualify to have the account open for more than 5 years AND you've reached age 59 1/2.

Why Transferring Traditional Tsp To A Roth Ira Makes Sense For Many Federal Employees

When you plan to contribute after-tax money, you need to make sure it makes the most financial sense from a tax planning standpoint.

By focusing on what your tax obligations are today, you can better assess whether it makes long-term financial sense to contribute to the TSP before or after taxes.

A ROTH TSP is a great tool, but make sure it's the right tool for the job you're doing when evaluating a traditional vs. ROTH TSP.

We've seen the mistakes people (and even some professionals!) can make, and we want to help you avoid them. Click the button below to learn more.

Can You Have A Roth Tsp And A Roth Ira?\

Next There is a 10% penalty to sign up for a direct withdrawal of $1,250 per month (not an annuity) from the TSP if I retire on my MRA @ 56 (but it won't be 59 1/2) Next

"I have been in the federal system for 3 years and will retire in the next 5 years. I am 62. I have a lot of money

"I am so grateful that you put your information on podcasts and emails. This really benefits the federal government employees and I share your information on all of these topics

"If I started in the NAF system in 1996 and then switched to GS in 2008, we were told that it would count towards the pension. From doing my research, just my

Backdoor Roth Ira 2023: A Step By Step Guide With Vanguard

"My wife and I updated our will two years ago, stating that all our assets would go to our survivors and that if anything were to happen

Get the most out of your federal retirement benefits with FERS resources created by Micah Shilanski, CFP® and the team of independent financial advisors at Shilanski & Associates, Inc. Join the thousands of federal employees who trust us to guide them on their retirement planning journey with our unique perspectives on how your FERS benefits contribute to your comprehensive financial plan.

Year after year, I see federal employees missing the same critical concepts in their federal retirement planning. That's why I created an online workshop to educate federal employees about these critical concepts.

:max_bytes(150000):strip_icc()/WorkRetirement-56eeac473df78ce5f8395f69.jpg)

Advisory services offered through Shilanski & Associates, Inc., an investment advisor doing business under the name "Planning Your Federal Retirement." Plan Your Federal Retirement is not employed by or represents the United States Federal Government. All content on this page is for informational purposes only. This website is not personal investment advice. Investing in securities involves risks, including the possibility of losing capital. There is no guarantee that any investment plan or strategy will be successful. Please read our Customer Relationship Summary (Form ADV Part 3) for important information about our services and fees.

Retirement Success Habit: Getting Your Tsp Ready For 2018

The opinions expressed herein are solely those of Shilanski & Associates, Incorporated, unless otherwise expressly stated. The material presented is believed to be from reliable sources and our company makes no representations about other parties, the accuracy or completeness of the information. Any information or ideas provided should be discussed in detail with a consultant, accountant or legal advisor prior to implementation.

The content provided herein is for informational purposes only and should not be used or construed as investment advice or a recommendation to buy or sell securities. There is no guarantee that forward-looking statements or opinions will prove to be accurate. Investing in securities involves risks, including possible loss of principal. There is no guarantee that any investment plan or strategy will be successful.

Your privacy is our top priority and we promise to keep your email secure! See our privacy policy for more information. Who would win in a traditional TSP vs. Roth TSP? This is one of the most common questions I get from my readers. It's also something I've been very confused about myself for a long time. TSP is one of the best retirement benefits of working for the federal government and a large part of federal retirement benefits. When I started investing for retirement in my 20s, everyone told me that Roth accounts were much better than traditional accounts. Now in my 30s, I invest most of my retirement savings in traditional tax-deferred accounts. In this post, I try to break down the differences between a Roth TSP and a traditional TSP so you can decide which one is better for you.

Please do not mistake my personal blog for financial advice, tax advice, or official US government opinions. This post may contain affiliate links. If you make a purchase after clicking the link, I will receive a small percentage of the sale at no additional cost.

Roth Ira Vs. Traditional Ira: Key Differences

Note – I have written several posts talking about my own TSP strategy. To learn more about my journey, read about how I work to maximize TSP contributions. Retirement age? Read my complete guide on how to withdraw money from a TSP.

Disclaimer – I am not a financial advisor or CPA. Do not mistake my blog for professional advice or the official position of the US government. I also

Roth tsp, roth or traditional tsp, traditional or roth ira, roth or traditional, roth vs traditional tsp, traditional and roth tsp, which is better roth or traditional tsp, difference between traditional tsp and roth tsp, is tsp a roth or traditional ira, roth ira or tsp, benefits of roth tsp vs traditional, traditional vs roth tsp calculator

0 Comments